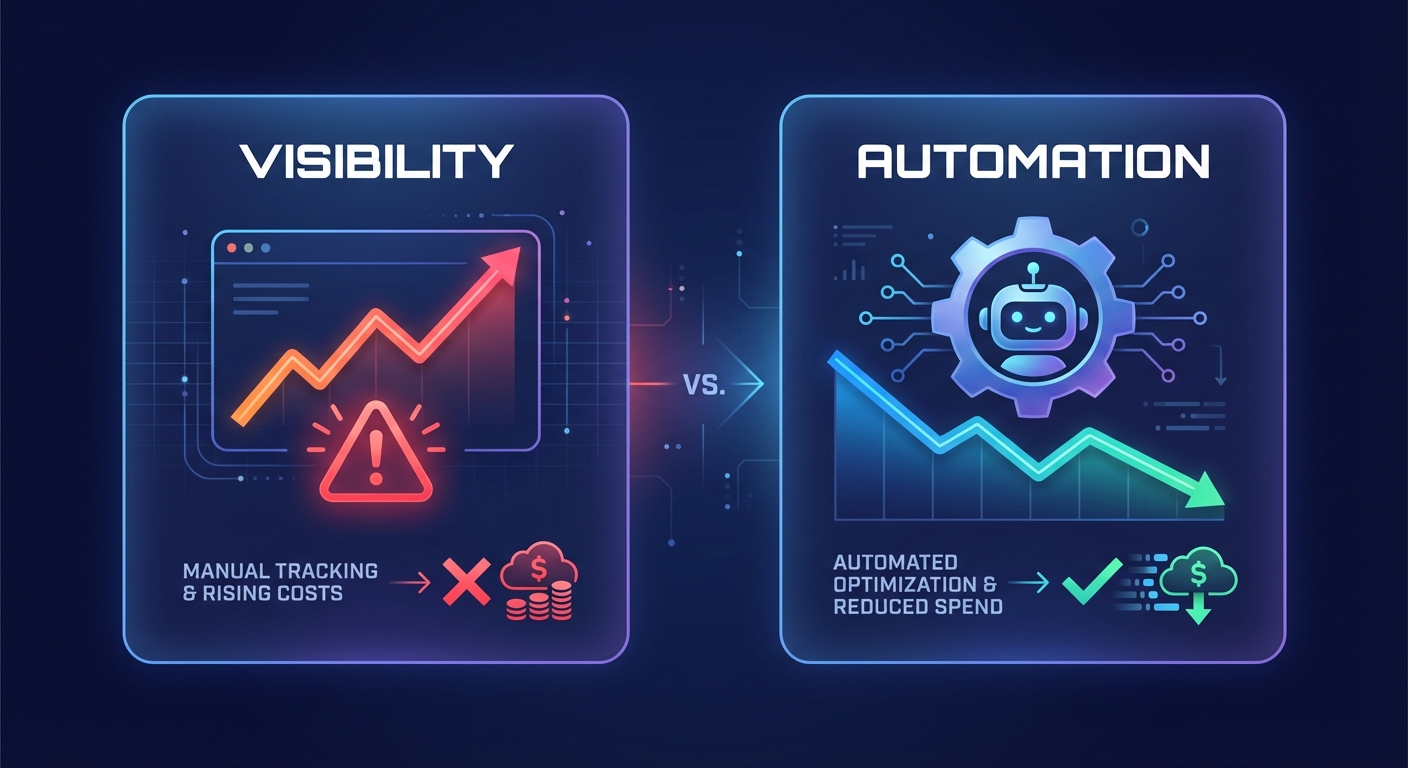

Over 30% of organizations waste cloud infrastructure spend due to poor governance and inadequate monitoring. If you are managing a growing AWS environment, you need to decide if you want a dashboard that displays your losses or an automated engine that recovers them.

Native AWS tools: The visibility foundation

Every journey into cloud financial management begins with the resources already available in your console. AWS provides a robust suite of entry-level tools designed to provide a historical perspective on your spending. AWS Cost Explorer serves as the retrospective gold standard, offering up to 38 months of historical data and granular filtering that allows you to slice costs by service, region, or usage type.

When you pair this analysis with AWS Budgets, you transition from observation to governance. Budgets allows you to set forward-looking alerts and trigger automated account actions when spending hits specific thresholds. This combination creates a solid baseline, but it often highlights a significant gap in the FinOps lifecycle: native tools like AWS Trusted Advisor can flag idle resources and over-provisioned instances, but they cannot fix them for you. For engineering leaders, this usually results in an endless “to-do list” of optimization tasks that are consistently deprioritized in favor of shipping new features.

Third-party visibility: Multi-cloud and Kubernetes attribution

As environments grow in complexity, native tools often struggle to provide the granular attribution required for modern microservices. For organizations running heavy containerized workloads on EKS, solutions like Kubecost or the CNCF-backed open-source cloud cost management project, OpenCost, are essential. These tools provide pod-level tracking that standard AWS reports cannot reach, allowing you to see exactly which deployment or namespace is driving your monthly bill.

These visibility-first platforms are highly effective for finance leaders who need to allocate shared costs effectively across different departments. By implementing robust tagging governance, you can transform a monolithic AWS invoice into a series of actionable showback reports. However, even with the best reporting, the “human in the loop” remains the bottleneck. You still require an engineer to manually execute rightsizing recommendations or rebalance instance types to see any actual reduction in spend.

Automation-focused tools: Hands-off optimization

The highest return on investment in the FinOps space comes from tools that shift from reporting to execution. While visibility identifies waste, automation eliminates it. Solutions such as nOps or Spot by NetApp focus on the orchestration of Spot instances and compute provisioning, but they often require significant configuration. This is where automated cloud cost management layers like Hykell differentiate themselves by operating on total autopilot.

Modern automation focuses on AWS rate optimization and infrastructure tuning, such as accelerating Graviton gains, without demanding hours of engineering time. This approach ensures that your discount coverage – including Savings Plans and Reserved Instances – is always optimized for your current usage patterns. By moving the burden from your DevOps team to an intelligent system, you ensure that you only pay for the compute power you actually consume.

Comparing the leading cloud FinOps categories

| Category | Primary Tools | Best For | Main Pros | Main Cons |

|---|---|---|---|---|

| Native AWS | Cost Explorer, Budgets, Trusted Advisor | Small to mid-size environments | Deep AWS integration and zero additional cost | Entirely manual and time-consuming |

| Visibility/Reporting | CloudZero, Finout, CloudHealth | Multi-cloud enterprise finance teams | Detailed dashboards and custom reporting | High licensing fees; requires manual effort |

| K8s Specialized | Kubecost, OpenCost, Karpenter | Heavy EKS/Kubernetes users | Granular pod-level attribution | Complex setup; limited to container costs |

| Automation | Hykell, nOps, Spot by NetApp | High-growth AWS organizations | Automated 40% savings with no engineering lift | Focused on specific cloud providers |

Finding the right fit for your environment

Determining which tool to implement depends largely on the scale of your infrastructure. If your environment consists of fewer than 50 instances, standard AWS cost monitoring tools and occasional manual fixes are usually sufficient to keep waste in check. However, once you scale past 500 instances or enter a period of high growth, the manual approach becomes a financial liability.

For engineering leaders, the primary friction point is the time required to implement rightsizing recommendations. This is why Hykell emphasizes zero code changes and zero active effort from DevOps. By utilizing AI-powered commitment planning, you can achieve an effective savings rate (ESR) of 50–70% on compute without disrupting your product roadmap or causing downtime.

An effective FinOps strategy should combine native tools for basic visibility with an automation platform to capture high-impact savings. This ensures that cloud cost anomalies are detected early and that your infrastructure is always running on the most cost-effective instance types available.

Stop leaving 30% of your cloud budget on the table while your engineers focus on features instead of infrastructure maintenance. Hykell provides a performance-based model where we only receive a slice of the savings we actually generate for you. Calculate your potential AWS savings today and discover how you can reduce your bill by up to 40% on autopilot.