“We’re already saving as much as we can.”

“Our AWS team says we’re fully optimized.”

“There’s nothing more to do—we’re maxed out.”

We hear this all the time.

And honestly? We get it. AWS is a beast, and managing costs can feel like taming a lion with a spreadsheet. Many customers think they’ve pulled every lever. But when we dig in, there’s almost always more juice to squeeze.

At Hykell, we specialize in those ‘you don’t know what you don’t know’ moments.

Let’s walk through a story we’ve seen again and again—one that highlights the real-world tradeoffs of AWS discounting. It’s not just about cutting spend—it’s about balancing discounts vs. commitments. In other words:

How much flexibility do you want, and how much discount are you willing to trade for it?

The Four Customer Profiles of AWS Discount Coverage

To make things simple, we’ve categorized the typical coverage approaches we see into four profiles. Think of them as characters in a cost optimization drama.

1. The Nomad – No Committed Coverage

This customer lives entirely in the On-Demand world. Maybe they just started on AWS. Maybe their workloads are seasonal, unpredictable, or constantly shifting. Or maybe they’re just not ready to commit.

Pros: Maximum flexibility.

Cons: No discounts. Every hour, every dollar, full price.

In AWS terms, this is like walking into a supermarket every day and paying sticker price for everything—even if you buy the same groceries every week.

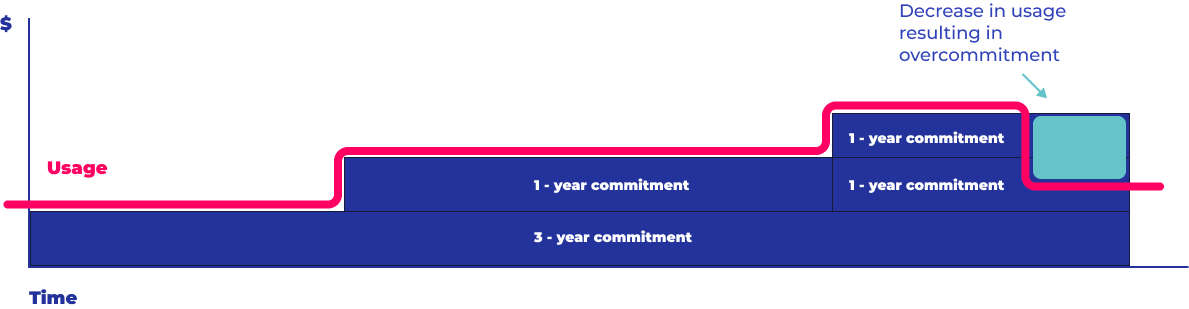

2. The Strategist – A Mix of 3Y, 1Y, and On-Demand

This is the savvy middle-of-the-road customer. They’ve grown into AWS. They understand their baseline workloads, so they make 3-year commitments for those. For newer or scaling apps, they stick to 1-year Reserved Instances or Savings Plans. And they keep a portion on On-Demand for burst capacity or experimentation.

They’re also not afraid to mix payment terms—some All Upfront, some Partial, some No Upfront.

Pros: Solid discounts, while maintaining flexibility.

Cons: Still may be leaving money on the table due to fragmented commitment strategy.

This is the customer who shops in bulk for the things they know they’ll use, but keeps a flexible budget for weekend impulse buys.

3. The Conservative – 3Y and 1Y Coverage, No On-Demand

These customers have locked in everything. They have a predictable environment, steady workloads, and an aversion to variable costs.

Or maybe they were once like The Strategist, but overcommitted and had a usage dip. Now their usage is perfectly covered—but also perfectly rigid.

Pros: Maximum discounts.

Cons: Zero flexibility. Any uptick in demand? Full price. Any downturn? You’re still paying for unused commitments.

This is like subscribing to a meal delivery service for three meals a day, seven days a week—even if you travel half the month.

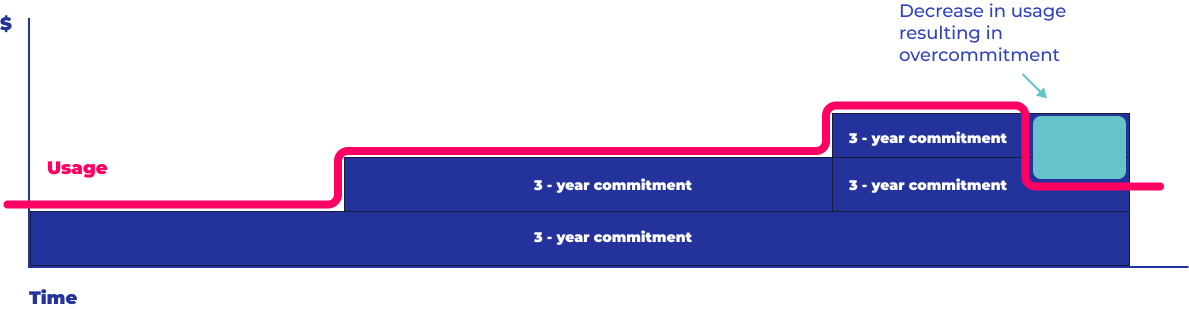

4. The Overcommitter – All 3Y, No On-Demand, No Cushion

This is The Conservative turned up to 11. Every dollar of compute is committed long-term. There’s no room for error, no room for scale, no room for change.

Pros: Slightly better effective rate per hour.

Cons: Exposure to risk. If something shifts—an acquisition, a pivot, or just a bad quarter—you’re locked in.

This is what happens when finance drives the AWS strategy without talking to engineering.

So, What’s the Right Answer?

There’s no one-size-fits-all solution. That’s the point.

The real trick is to intelligently combine the various discount instruments AWS offers: Reserved Instances, Savings Plans, Convertible vs. Standard, 1Y vs. 3Y, All Upfront vs. No Upfront—and to build a coverage plan that matches your business strategy, not just your usage chart.

This is where Hykell helps.

We act as your personal AWS discount concierge—figuring out how to layer your coverage, optimize existing commitments, and stay flexible enough to pivot when your infrastructure (or business) evolves.

But Wait—Aren’t These Tools Available to Everyone?

Yes. AWS doesn’t hide these instruments. But using them well? That’s a different story.

Think of it like tax deductions. They’re available to everyone, but most people aren’t using all of them. Why? Because it takes time, context, and expertise to apply them properly. That’s exactly what we bring to the table.

We’ve helped customers who already had “full coverage” save another 20–30%. Not by magic, just by nuance.

TL;DR: You Can Be Covered and Still Be Exposed

The idea that “we’re fully covered” is usually just a reflection of what someone believes is optimal. But real optimization is dynamic—it changes as your business, teams, and environments change.

Having the right mix of discount instruments, with the right balance between coverage and flexibility, is a continuous process.

Want to see how much more you could be saving—even if you think you’re maxed out?

Get a free cost profile analysis today: hykell.com/contact

We’ll help you find what you didn’t know you were missing.