Are you walking into your AWS EDP renewal with a strategy or just a spreadsheet? Most enterprises unknowingly leave 20% or more of their potential savings on the table by committing to spend levels they haven’t yet optimized.

The AWS Enterprise Discount Program (EDP) – often referred to as a Private Pricing Agreement (PPA) – is a powerful lever for mid-market and enterprise companies spending over $1 million annually. However, without the right data and a proactive FinOps framework, a poorly structured agreement can lock you into years of “commitment debt” and mandatory support fees that erode your actual ROI.

Understanding the EDP structure and eligibility

To qualify for an EDP, your organization typically needs a minimum annual spend of $1 million. In exchange for committing to a specific dollar amount over a one- to five-year term, AWS provides a tiered discount across almost all services. This commitment acts as a volume discount, rewarding organizations that can accurately predict their long-term cloud consumption.

However, the math is rarely straightforward. One of the most common pitfalls is confusing “gross spend” with “net commitment.” EDP discounts do not count toward your total annual commitment; you are committing to spend a specific amount after discounts have been applied. If your usage drops or you optimize too late in the cycle, you may face shortfall payments for the difference. This makes the accuracy of your cloud cost forecasting essential before signing the dotted line.

Contractual pitfalls to avoid during negotiation

Negotiating an EDP requires looking beyond the headline discount percentage. AWS contracts include several “gotchas” that can significantly impact your effective savings rate. For instance, the Enterprise Support mandate requires all accounts under an EDP to be enrolled in Enterprise Support, which typically costs 3% of your monthly spend or a minimum of $15,000 per month. For many organizations, this added cost can offset a significant portion of the negotiated discount.

The Marketplace cap is another critical factor. While organizations previously used AWS Marketplace purchases to cover up to 50% of their commitment, this has recently been reduced to 25% in many newer agreements. Furthermore, the “commitment floor” creates a ratchet effect where you generally cannot reduce your annual commitment below the previous year’s level. This ensures your costs can only escalate, even if your engineering team finds massive architectural efficiencies. Additionally, as of January 2024, EDP customers are prohibited from selling discounted Reserved Instances on the AWS Marketplace, further reducing your ability to offload excess capacity.

Tactics for a stronger negotiation position

The best time to negotiate your EDP is after you have already cleaned up your infrastructure. If you sign an agreement based on wasteful spend, you are essentially committing to continue wasting money for the duration of the contract. Navigating these constraints requires a proactive strategy that centers on efficiency and consolidation.

Optimize before you commit

You should use automated AWS rate optimization to identify and eliminate underutilized resources before finalizing your spend forecast. By rightsizing your instances and storage, you can reduce your baseline spend by 30–40%. This allows you to sign a smaller, safer commitment while still securing high discount tiers, effectively giving you more room to grow without the fear of shortfall payments.

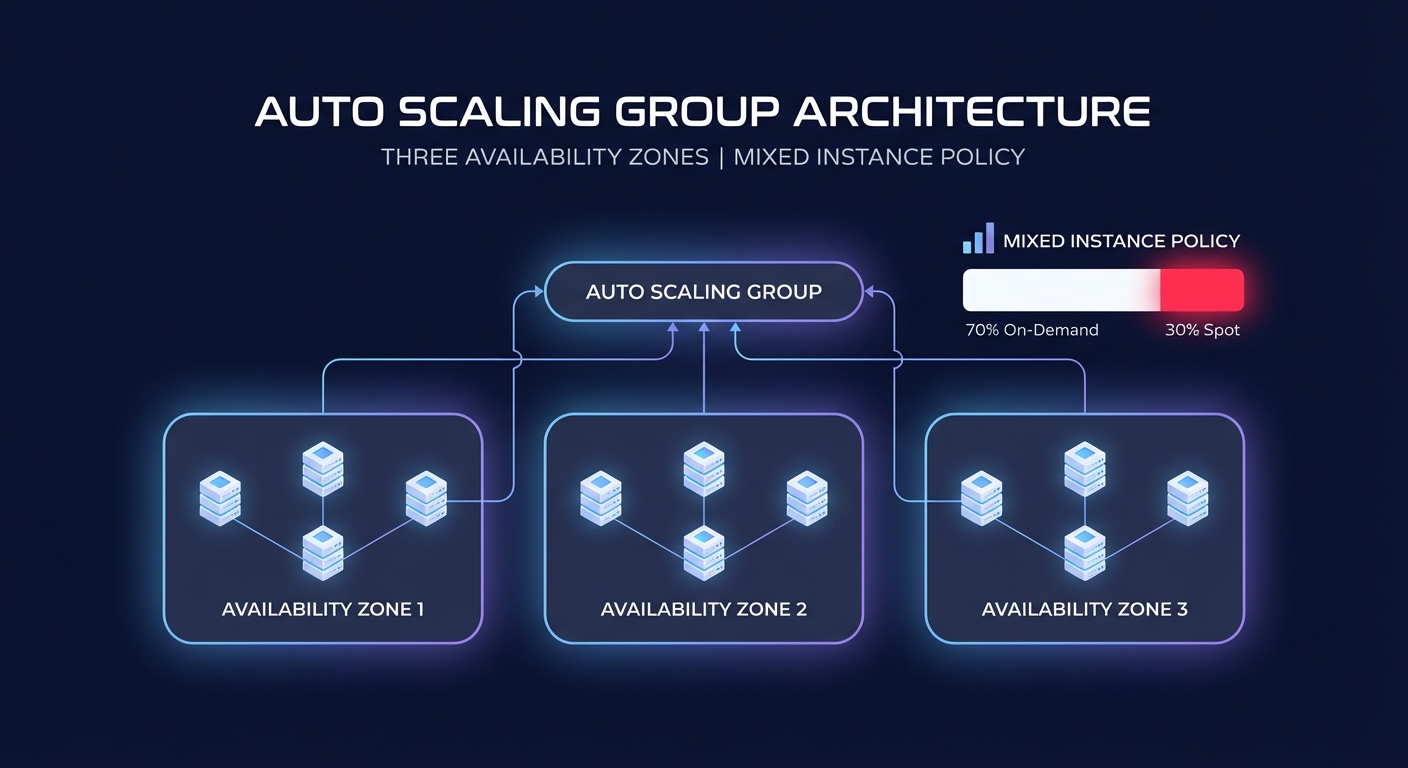

Leverage a blended commitment strategy

Do not rely solely on the EDP for savings. You should combine your enterprise agreement with a mix of Savings Plans and Reserved Instances. By using Hykell to manage these instruments, you can maintain a high Effective Savings Rate (ESR) without the risk of over-committing to a rigid multi-year EDP floor. This hybrid approach allows you to capture the deep discounts of specific instance commitments while the EDP provides a broad safety net for your entire portfolio.

Consolidate accounts for volume leverage

To maximize your leverage, ensure all linked accounts across your organization are consolidated under a single management account. This aggregates spend across every department and project, pushing you into higher discount tiers faster. Consolidation also provides the visibility needed to track monthly commitment drawdown, helping you manage true-up risks before they become financial penalties.

How Hykell strengthens your negotiation and ongoing savings

Negotiation is not a one-time event; it is a continuous process of aligning your contract with your actual usage. This is where most internal teams struggle, as engineering is often focused on shipping features while finance manages the budget. Hykell bridges this gap by acting as an automated extension of your team, providing the data needed to secure favorable terms.

Data-driven leverage

Hykell provides the granular visibility needed to prove your actual steady-state usage. When you know exactly how much of your spend is elastic versus predictable, you can negotiate a floor that protects you from shortfall payments during major architectural shifts. This data-backed approach shifts the power dynamic in negotiations, moving you away from AWS’s generic projections and toward your actual business reality.

Elimination of commitment debt

Many companies fall into the trap of managing AWS commitments manually, leading to “stranded” discounts and rigid portfolios. Hykell’s AI-powered platform continuously buys, sells, and converts RIs and Savings Plans in the background. This ensures that even as you fulfill your EDP commitment, you are doing so at the most efficient rate possible, preventing the accumulation of commitment debt that often plagues unmanaged accounts.

Performance-based pricing

We believe you should not pay for the promise of savings, but for the delivery of them. The Hykell pricing model is designed to align with your success: we only take a slice of what we actually save you. If we do not reduce your AWS bill, you do not pay. This ensures that our primary focus remains on maximizing your discounts and maintaining the flexibility your engineering team needs to innovate.

Secure your cloud financial future

An AWS EDP can be a massive asset or a restrictive liability depending on your negotiation strategy. By optimizing your infrastructure first and leveraging automation to manage the ongoing complexity, you can secure the best possible terms without sacrificing your agility.

Stop guessing your commitment levels and start negotiating with data-driven confidence. Calculate your potential savings today and see how Hykell can help you slash your AWS costs by up to 40% on autopilot.